Tokenomics

Understanding the LCI token and the stablecoin token LUCI

LCI Token Contracts

| Token | Chain | Contract Address |

|---|---|---|

| LCI | Polygon | Contact Address |

| LUCI | Polygon | Contact Address |

What is LCI and LUCI

Lucia aims to build a permissioned, open, and collaborative credit data network. In future releases, Lucia shall be a permissionless credit protocol.

Utilities of LCI

-

Paying for Loan Origination Fee: Loans originated through Lucia will incur a 0.3% fee

-

Query Sybil data: Developers that use Lucia to query for identity data for sybil detection purposes will pay a fee. This can be paid in fiat or it can be paid in LCI tokens

-

Governance

-

Staking

For more information, see the section titled Sinks and Sources in this document

LUCI is a stablecoin

-

It's value is pegged to that of the US dollar

-

LUCI stablecoins represent the credit balance a token has

What is the Lucia Credit Score?

Our ZK credit identity score is transportable between platforms, therefore other companies leverage our data to understand the financial metrics of each customer. Borrowers use the app to borrow up to their credit limit. They pay interest on outstanding balances. They can buy goods in the web 2.0 world with a 16 digit virtual credit card our app supplies, and of course they can also use the funds to pay via crypto.

Token Overview

LCI: Native Protocol Token

| Token Ticker | LCI |

|---|---|

| Token Type | ERC20 |

| Blockchain Explorer and Smart Contract Address | Defined in above section |

| Max Supply | 100,000,000 |

| Initial Circulating Supply | 20,000,000 |

| Additional Issuance | Inflation rate for first 2 years post TGE shall be 9%. Inflation rate for year 2 to 4 following TGE shall be 7%. After 4 years, inflation rate shall be 5%. |

| FDV | $22,860,000 |

| Public Sale Price | $0.2286 |

| Smart Contract Audit Report | In Progress - to be finalized prior to TGE |

| CEX Listing Partners | MEXC, Coinstore |

| Target Demographics | All European Union countries, Nigeria, Kenya, Ethiopia |

LUCI: Lucia Stablecoin

| Token Ticker | LUCI |

|---|---|

| Token Type | ERC20 |

| Blockchain Explorer and Smart Contract Address | Defined in above section |

| Max Supply | Dynamic - based on CDP size |

| Initial Circulating Supply | Dynamic - based on CDP activity |

| Public Sale Price | $1.00 |

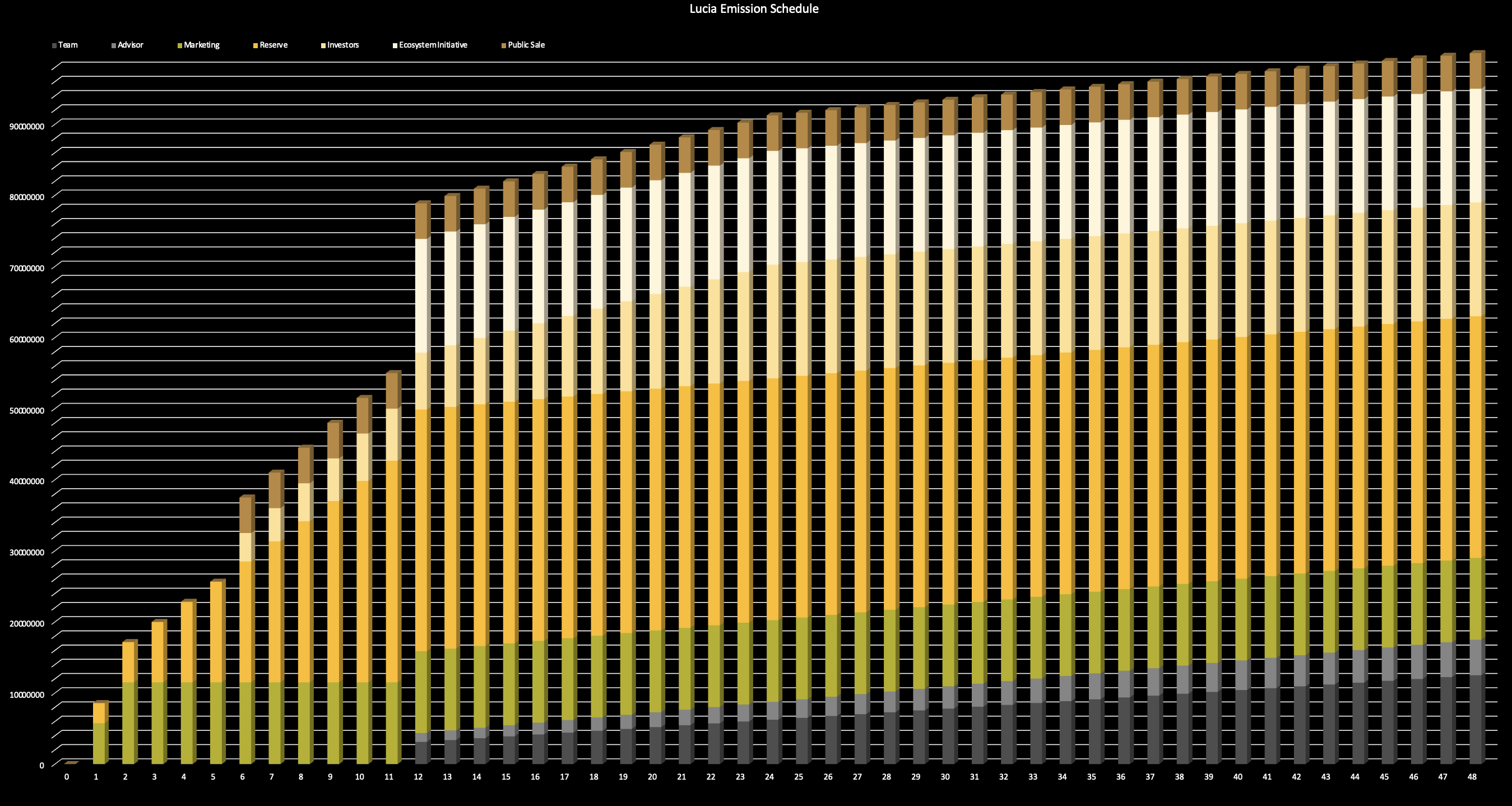

Release Schedule

| Token Allocation | Amount of Token | % of Total Supply | Unlock % at TGE | Cliff Period (months) | Vesting Period (months) |

|---|---|---|---|---|---|

| Team | 12.5M | 12.5% | 0% | 12 | 48 |

| Advisor | 5M | 5% | 0% | 12 | 48 |

| Marketing | 11.5M | 11.5% | 0% | 1 | 2 |

| Reserve | 34M | 34% | 0.0043% | 0 | 12 |

| Investors | 16M | 16% | 15% | 6 | 24 |

| Ecosystem Incentive | 16M | 16% | 16.667% | 12 | 12 |

| Public Sale | 5M | 5% | 0% | 6 | 6 |

| TGE | 100M | 100% | 16.6713% | 6-12 | 0-48 |

Note: Community allocation of tokens earned via Galxe and awareness campaigns can be used for staking even while locked.

Visual Representation

Legend

Market Valuation Justification

Currently we have a Decentralized Exchange LuciaDEX launched on mainnet for Manta and Polygon. Website: https://app.luciadex.com

To determine the starting price of the token, we did a TAM/SAM/SOM analysis. More info can be found here.

Initially, traders that undergo KYC can be approved to borrow for trading purposes.

Later, all consumers that are qualified in our risk underwriting model are approved to borrow for any general purpose.

💼 Business Model

Merchant Processing Fees + Loan Origination Fees

With our payment processing integration partners. Merchants are willing to accept a 4.5% fee for all credit transactions. Our target market focuses on merchants that work in high margin industries such as education, SaaS, Biotech, Pharmaceuticals, Jewelry and Luxury goods, High end fashion. In these industries, even with a 4.5% fee they are making a significant profit.

Active Balance Interest Rate Fees + Bringing the next 500 million users into web3

Lucia Protocol has the opportunity for a first mover advantage in emerging markets. Many processes such as airdrops, earning rewards in GameFi games and platforms, require no upfront capital investment on behalf of the user. In many jurisdictions, crypto is favored as a hedge against price fluctuations of their local fiat currency.

Additionally, we become a gateway for a large volume of new users into the web3 space. We can establish a wide range of partnerships with L1's, exchanges, wallets and other firms in the ecosystem.

Use Case Examples

-

Retaining users in GameFi: Gaming companies wish to use our credit card. They have an in-game ecosystem. Buyers are rewarded when they spend. The game gives more rewards to those that make buy or sell decisions on a daily basis than those that log in once a month, to maximize engagement in the game. Young adults good at the game can earn a considerable income and build their credit score.

-

E-commerce: You have factory connections in Vietnam to manufacture shoes, and have buyers lined up in the US. You’ve validated the market demand with a small paid ad campaign. You need initial capital to start your business since suppliers won’t manufacture unless you give them a large minimum quota.

-

Last minute cashflow shortage: You book a flight with an airline aggregator. They book a ticket but a connecting flight is with Lufthansa which has a policy where last minute bookings require a call. You’re money is in this limbo state, you can’t buy an additional ticket in case the booking goes through, if the booking fails you may have a 3-5 business day wait period to get your money back.

-

Interest Rate Arb: Japanese homeowners mortgage their home and pay 2% interest and gain an excess of over $200,000 (¥30,967,100) ****in liquidity. They exchange JPY for Bitcoin or Ether then deploy capital to pools and lend to borrowers with good credit scores in regions with medium to high cost of capital. They make between 26% to 43% APY (26 = 28 - 2, 43 = 45 - 2) not including capital gains from long exposure of BTC or ETH.

Token Price and Market Cap Justification

We intend to pick a fair price for the valuation of the company during TGE. The valuation method we use is Gross Revenue * Industry Multiplier

Assume industry multiplier is 18x.

SOM in ARR is $1.27M. That puts the valuation of the company during TGE to be $22,860,000. Starting price of token shall be $0.2286

Sinks and Sources

As we launch, it is important to consider all the sinks or essentially the demand drivers of the token.

Near Term Sinks

We define DEX Liquidity Injection Pools. Auction and routing mechanism akin to Uniswap V4 combined with our proprietary liquidity injection model.

Pain Point Resolved: Hedge funds can only trade 5% of the orderbook at a time without moving prices that much. Traders often have to write TWAP algorithms that can trade 1.5 BIPS at a time. Lucia Protocol enables LuciaDEX to be a highly capital efficient DEX.

Traders may also need short term loans. Some traders who do not have high credit scores in the system can lend to their trusted parties, which will incur a fee. Lucia borrowers will pay a 3% P2P transfer fee, which can be offset to 1.5% if they pay with the LCI token.

In Summary, near term sinks include

| Liquidity Injection | When a person with a high credit score collateralizes assets such as BTC, ETH, RWA's to receive an issuance of LUCI stablecoin, they can subsequently use this to inject into liquidity pools for even greater returns. They do not get a cashback reward however for non-merchant transactions. |

|---|---|

| P2P Transfer Fees | Discount on P2P Transfer fees. Effectively, the fee a guarantors pays to bootstrap liquidity for their borrowing counterparty |

| Governance | LCI token is used to make decision on fee schedules, interest rates, etc based on dynamic economic conditions |

| Debt Auction | System triggers liquidation. Collateral is offered at a discount but a fee of 1% is incurred. This becomes 0.5% if fee is paid in LCI token. |

🚰 Long Term Sinks

In the future, LCI shall be used not just for creating a highly liquid DEX, but can be used for any payment. Users in any market will access banking and credit card services provisioned end to end in an app.

| Default Burns | LCI Token is burned when loans or credit accounts default |

|---|---|

| P2P Transfer Fees | LCI Token is used for transaction fees for P2P Transfers that extend beyond the scope of approved traders |

| Origination fees | Each time a loan is originated through our underwriting system, there is a fee paid by the borrower to the originator |

🏞 Token Sources

Tokens are emitted at an inflationary schedule to promote adoption and growth.

Tokens are emitted when a high degree of trust is created in the system. Loans that are paid back in full within 3 months will create new tokens minted for both the borrower and the lender.

This scenario represents the ideal usecase of Lucia Protocol. A system representing decentralized trust between lenders and borrowers, where all borrowers are accountable to a high degree.

Tokens are also created by staking LCI in pools on LuciaDEX

Summary of Token Sources

| Loan payback | When a loan is paid back in full plus interest within 3 months, then 0.5% of the loan amount will be minted for the borrower and the lender |

|---|---|

| Staking | LCI tokens are paired in pools with WETH, MATIC, MANTA and many more highly liquid tokens. These pools on LuciaDEX accmumulate at a premium rate, this rate does not include the additional bonus rate proportional to the inflation rate |

Stablecoin Issuance

Our stablecoin system is based on collateralized debt positions

- Reserves are in ETH and other top 10 assets

- When LUCI stablecoin is emitted based on corresponding amount of CDP collateralized assets in the vault

- LCI is used to pay for fees accrued on CDPs

- LCI is used for governance for modifying the interest rates per region

Examples

🌎 Different Rates in Different States

Some countries such as Vietnam, Kenya have high cost of capital. Other countries such as Japan have low cost of capital. Interest rate will vary depending on what region of the world the borrower is legally based in.

| Relative Cost of Capital | Interest Rate per Annum |

|---|---|

| High | 45% |

| Medium | 32% |

| Low | 22% |

Comparison with existing products

| Card | APR per Month | APR per Annum |

|---|---|---|

| AMEX Platinum | 2.415% | 28.99% |

| Chase Sapphire | 2.0825% | 24.99% |

Most credit cards have an opaque acceptance policy and a 10 day wait period. We offer a 12 hour wait period and a transparent acceptance policy defined in our protocol whitepaper.

⨐ Breaking down the math

Let's say Charlie has a credit limit of $1,000 as determined by the protocol's underwriting process. He buys a plane ticket for $450.

Let's say the pool has $900 of liquidity, supplied by 2 liquidity providers Alice and Bob, each deposited $450 each.

At this point Alice earns 20% APY. Charlie, pays 32% APY each month. Charlie is required to pay $460.35 on month 3, and if he hasn't made any payments Charlie must pay $470.94 assuming he hasn't used his remaining credit limit. If Charlie waits until the end of the year he must pay $594.

The protocol accrues revenue via interest rate arbitrage, in this example at a rate of 12% APY.

Cases

- If Charlie pays back instantly, merchants will be charged 4.5%. Charlie is rewarded 2.5% cashback and 0.5% in LCI tokens

- The active balance period is 2 months. If Charlie waits 3 months, he will incur a APY 30% interest rate on the amount so he must pay back

⚖️ Operational Model

The utility of the LCI token is to create a self balancing mechanism

- A borrower borrows

X+Ydollars worth of LUCI token. When a unit of credit is not returned, a debt position is created. - There is an equal amount of LUCI Stablecoin created in a buffer pool, there is a 1 to 1 relationship between a borrower and the buffer pool associated with their account.

- When a specific dollar amount

Xof LUCI Stablecoin is partially repaid by the borrower in the debt position account, then an equal amountXof LUCI stablecoin is burned in the buffer pool. - Subsequently, when the borrower repays

Y+Interest accrual amountto his debt position, then the amountX+Ydollars of LUCI Stablecoin is burned in the buffer pool. The buffer pool is now empty. - The

Interest accrual amountis transferred to the Lucia Protocol Treasury and can be then allocated to either yield bearing accounts or to add liquidity to the Lucia default insurance pool.

♾ What happens if the borrower never pays back?

If the borrower does not pay back after a period of 2 years, then Lucia Protocol shall initiate legal proceedings with the borrower. This can be in the form of an injunction or wage garnishing. Methods are determined by best practiced based on jurisdiction of the borrower and the venue of law in which the legal agreement between the borrower and lender has been signed.

The buffer pool will continue to exist during this period until a formal resolution has been made by the court system.

🚀 Launchpads

| Launchpad | Sale Date | Public Sale Price | Amount of Token |

|---|---|---|---|

| Spores | 8/15/2024 | $0.2241 | 4,500,000 |

| Seedify | 8/15/2024 | $0.2241 | 7,000,000 |

| Pinksale | 8/15/2024 | $0.2241 | 7,500,000 |

| Chain GPT | 8/15/2024 | $0.2241 | 1,500,000 |

🎓 Technical Breakdown

[CDP Treasury] ---> [Pool 1] Borrowers can borrow unsecured

Overcollateralized [Pool 2] Borrowers can borrow undercollateralized

[Pool 3] Only overcollateralized loans

🔖 Collecting Past Debts

The most common question we get asked is how do we keep our protocol secured against bad actors? We have a 3 layer security system.

- KYC + Legal Agreement

- Attribution Identity System

- Biometrics

At its very core, if someone is a bad actor, our job is to find out who they are with very high certainty, with an accuracy of over 99.9999%.

If a user borrows and then defaults, they cannot borrow more. The user shall be legally obligated to pay back past debts plus accrued interest. Our protocol implements a Proof of Membership requirement for all borrowers.

Proof of Membership

Suppose you have an EVM chain compatible wallet. You want to ensure that the wallet belongs to a real person, without revealing which person it is. Let's call this proof of person. In business law, a corporation is treated as a person. Thus, this method applies to B2C and B2B loans. We can mathematically describe that function below

1️⃣ The private input ( w ): Your address A, and the private key k to your address

2️⃣ The public input ( x ): Essentially the set of all addresses with verified proof of person profiles

$$ {P_1,...P_n} $$

3️⃣ The verification function f(x,w):

- Interpret

was the pair(A,k), andxas the list of valid person entities

$$ {P_1,..P_n} $$

- Verify that

Aexists in the set of addresses

$$ {P_1,...P_n} $$

- Verify that

privkeyToAddress(k) = A - Return

Trueif both verification functions pass elseFalseif either fails

Even if malicious actors generate additional sybil accounts, for example they generate new public private keypairs with a script using web3.js or use Metamask, our attribution system can detect and nullify these sybils.

🦾 Machine Learning

When a user connects to our web interface, we collect a lot of information about that person. There are metadata fields that browsers and apps send every time they interact with a website. This includes:

| User Agent | Browser Version | Language | Locale |

|---|---|---|---|

| Timezone | OS | canvas hash | Screen width |

and about 10 other fields. Our proprietary AI algorithms combine these metadata fields along with information related to their crypto addresses to identify who the user behind the crypto address is. This technology is unique to Lucia Protocol, and as of today no other blockchain lenders have access to this data.

These sybil addresses funnel into our attribution profile filter, which then checks matches with existing biometric + KYC documents. When it detects a sybil match, the protocol denies the new account from interacting with the protocol.

Additional Information

More background on attribution models

Questions

Reach out to team@luciaprotocol.com for any type of inquiry.